What Is a Pool Car? Everything You Need to Know About the Rules, Exceptions, and Record Keeping

If your business provides a car for employees to share, and it’s used strictly for work, you might be able to classify it as a pool car. That’s a big deal from a tax point of view, because if you meet HMRC’s rules, there’s no benefit-in-kind charge for the employees who drive it.

But the conditions are strict, and the records need to be spot on.

Here’s a clear breakdown of what counts as a pool car, what HMRC expects, and how to stay compliant.

What is a Pool Car?

A pool car is a company vehicle used by more than one employee for business purposes only. It must not be allocated to any one person and must not be used for personal journeys, except where private use is truly incidental to a business trip.

If the rules are followed, HMRC will treat the vehicle as a pool car, which means there’s no benefit-in-kind tax for employees and no additional NICs for the business.

Pool Car Conditions: What You Have to Get Right

To qualify, all of the following must apply:

1. Shared by Multiple Employees

The car must be genuinely shared – it can’t be assigned to one person or regularly used by the same employee. HMRC expects to see different drivers and shared access.

2. Not Kept at Home

The car should not normally be kept overnight at or near any employee’s home. It should return to the business premises when not in use.

3. Only Incidental Private Use

Private use must be strictly incidental – for example, grabbing lunch during a client visit. It must not be used for commuting or personal errands.

4. Kept at the Main Business Address

When it’s not being used, the car should be kept at your business premises.

What Does ‘Incidental Private Use’ Mean?

HMRC expects any private use to be minor and secondary to business needs. Some examples can help clarify:

Examples of Acceptable Incidental Use

Stopping for lunch during a business trip.

Picking up a prescription or similar quick errand between client visits – but only occasionally.

Keeping the car overnight because of a late meeting or early start the next day – if it’s rare and business-driven.

Short detours, like dropping off a colleague at a station, as long as it’s not a regular habit.

What Doesn’t Count

Daily commuting.

Regular overnight parking at home.

Personal trips, even if the car is later used for business.

Using the car mainly for private journeys with the odd business trip.

What Records Do You Need?

HMRC will expect full evidence that your car meets the pool car rules. The more detailed and consistent your records, the better.

What to Keep

Journey logs – showing who drove, where, why, and mileage.

Overnight location – where the car was stored each night.

Driver allocation records – who used it and when.

A written policy that clearly prohibits private use.

Vehicle details – including emissions and how many cars are in your fleet.

Fuel logs, if the company pays for fuel.

Insurance policy – should be in the company name and cover all employees, not just named drivers. HMRC often checks this.

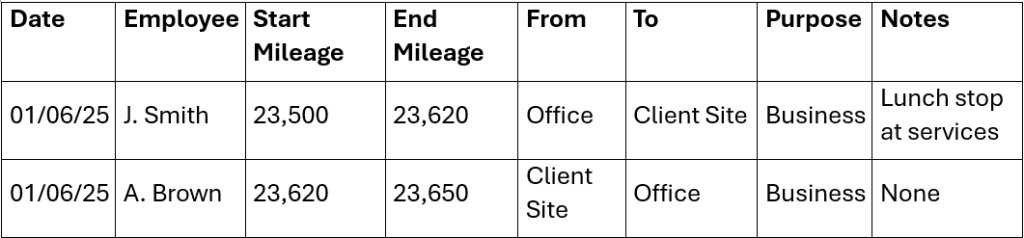

Example Journey Log Table:

How Long to Keep Records

Keep for at least six years from the end of the relevant accounting period.

For capital assets like vehicles, keep records for six years after the vehicle leaves the business.

Final Thoughts

Pool cars can be a great way to provide access to company transport without triggering a benefit-in-kind charge, but only if HMRC’s rules are followed to the letter.

The key things to get right:

Shared use only.

No regular home storage.

Private use must be rare and minor.

Clear logs, policies, and insurance in place.

If you’d like a logbook template or want to check your setup is compliant, get in touch with us – we’ll help you keep things straightforward, tax-efficient, and HMRC-proof.